Used containers: soaring costs never seen before

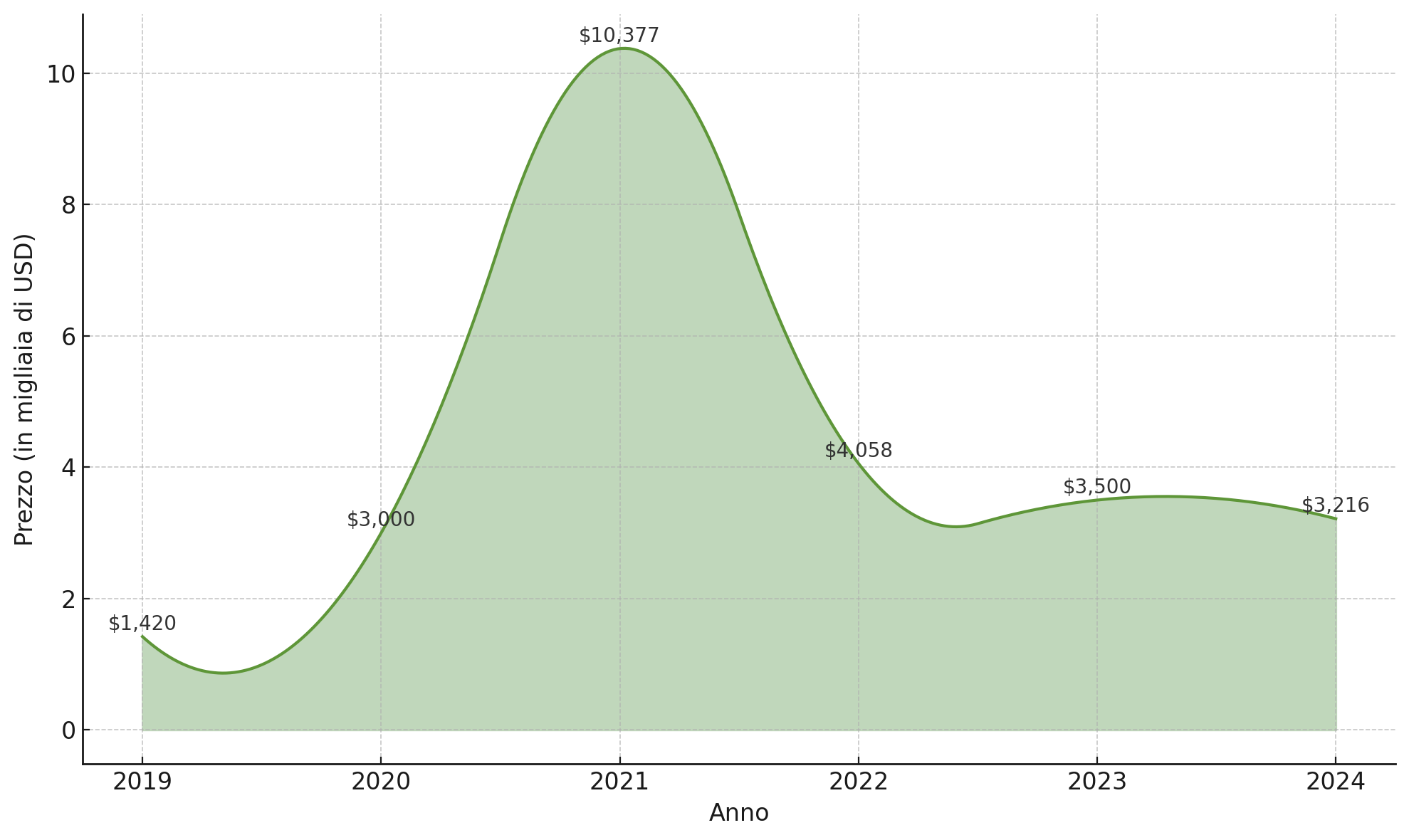

The container market continues to be a crucial barometer for the global economy and international trade. While we were witnessing an unprecedented cost surge in 2021, the 2024-2025 landscape is considerably more complex, requiring in-depth analysis to understand the dynamics at play and future prospects related to container prices.

From the crisis of 2021 to the current scenario

In 2021, used container prices reached record levels. A used 40-foot High Cube container, which before the pandemic was around $1000 to $1500, came to cost between $5300 and $7500. These increases were mainly due to:

- Global port congestion

- Imbalances in container supply and demand

- Rising costs of raw materials

- Disruption in global supply chains

Soaring sea freight costs and port congestion altered the dynamics of international logistics, helping to polarize trade in certain areas of the world and fueling a container shortage that has been growing since the mid-2020s. Demand for containers reached unprecedented peaks, while shipowners had to contend with fluctuating raw material costs and production lead times.

According to an analysis by the World Container Index (WCI), the container shortage was set to last through 2021, with supply and demand expected to balance out and a decrease in ocean freight rates expected no earlier than 2022.

Price trends for used 40′ High Cube containers (2019 – 2024)

Technical analysis of the 2024-2025 market

Container Price Sentiment Index (xCPSI)

The Container Price Sentiment Index (xCPSI), a key indicator developed by Container xChange, provides valuable information on price expectations in the container market.

Trend of the xCPSI from 2023 to 2024 (source Container xChange)

The xCPSI trend shows a steady increase in the final months of 2024, indicating that a growing number of supply chain professionals globally expect container prices to rise. This sentiment is mainly driven by limited container supply in certain regions, steady demand despite global economic challenges, and geopolitical uncertainties affecting trade routes.

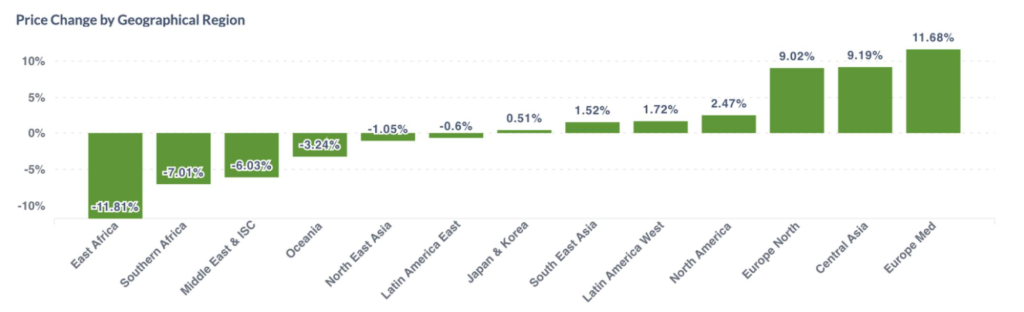

Regional price analysis

Detailed analysis of average container prices by region reveals significant trends.

| Container Type | Condition | Minimum Price ($) | Maximum Price ($) |

|---|---|---|---|

| 20′ Container | First Trip | 2,500 | 2,800 |

| 20′ Container | Used | 1,400 | 1,600 |

| 40’ HC Container | First Trip | 3,600 | 4,000 |

| 40’ HC Container | Used | 1,600 | 1,900 |

| 40’ HC Reefer Container | New | 21,000 | 25,000 |

| 40’ HC Reefer Container | Used | 8,000 | 12,000 |

| 20’ Flat Rack Container | Used | 3,000 | 3,300 |

| 40’ Flat Rack Container | Used | 3,800 | 4,300 |

| Open Top Container | Used | 4,000 | 4,500 |

| 40’ HC Double Door Container | First Trip | 4,000 | 4,500 |

| 20’ HC Double Door Container | First Trip | 3,000 | 3,400 |

| 20’HC Side Door Container | New | 5,500 | 6,500 |

United States

In the United States, relative price stability is observed, with minimal fluctuations compared to other regions. This stability can be attributed to several factors. First, there is a balance between domestic demand and import flows, which reduces pressure on container costs. In addition, retailers effectively manage inventory, ensuring a steady and predictable supply. Finally, the impact of nearshoring, which leads companies to move production closer to consumer markets, has had a positive effect on container distribution, contributing to market stability.

Asia

In Asia, there is an increase in prices, particularly pronounced in China, despite a decrease in production. This apparent paradox can be explained by several factors. The reorganization of global supply chains has changed the demand for containers, directly affecting prices. The phenomenon of nearshoring has also changed container flows, shifting production to markets closer to the end consumer. In addition, the reduction in new container production due to the global economic slowdown has further fueled price increases.

Europe

In Europe, price increases have been moderate, but still significant. This increase has been influenced by several factors, including geopolitical tensions in Eastern Europe, which have altered trade flows in the region. In addition, the European Union’s energy transition policies have imposed new challenges on transportation companies, increasing operating costs. Adapting to new trade routes post-Brexit has also impacted prices, changing international trade dynamics and increasing logistics costs.

Middle East

The Middle East stands out for its high price volatility, with a 6 percent decline followed by a sudden 7 percent increase in early October 2024. This instability is closely linked to regional tensions, which affect trade flows, particularly in the Red Sea. In addition, fluctuations in the energy market play a key role, as the region is heavily dependent on trade in energy resources. Finally, adjustment to sanctions and trade restrictions has contributed to market volatility, creating uncertainty in supply and demand flows.

Average changes in container prices over the past 30 days, as of Oct. 3, 2024, at the regional level (source Container xChange)

Impact of geopolitical events

Geopolitical events are playing a crucial role in shaping the container market.

Israel-Iran Tensions

Escalating tensions between Israel and Iran, with Iran firing missiles into Israel and Hezbollah attacks from Lebanon, have led to significant disruption in the Red Sea. Houthi rebels continue to target commercial ships, intensifying pressure on global shipping capacity. These events are causing delays and cost increases for international trade routes, affecting the entire container market.

US Elections

Uncertainty related to the upcoming U.S. presidential election on November 5, 2024 is creating volatility in the U.S. container market. Potential changes in trade policies, particularly in terms of tariffs and international agreements, could have global repercussions, altering container supply and demand both domestically and internationally.

Analysis of supply and demand

The relationship between container supply and demand is undergoing a rebalancing phase, with different dynamics in different regions.

Demand

Changes in demand show significant differences between regions. In the United States, demand remains stable in the short term, but fluctuations related to the reordering cycle may occur, especially coinciding with the Chinese New Year. In Europe, demand is rising slightly, driven by the post-pandemic economic recovery, which is revitalizing business activities. In Asia, demand for export is declining, but is increasing for intra-regional trade, following an adjustment in domestic trade flows.

Supply

Container supply is undergoing major changes in response to changing market conditions. In China, production of new containers is declining due to the economic slowdown, while other Asian countries, such as Vietnam and Indonesia, are seeing increased production. At the same time, there is growing interest in repurposed and prefabricated modular containers as a response to the global market’s need for flexibility and sustainability.

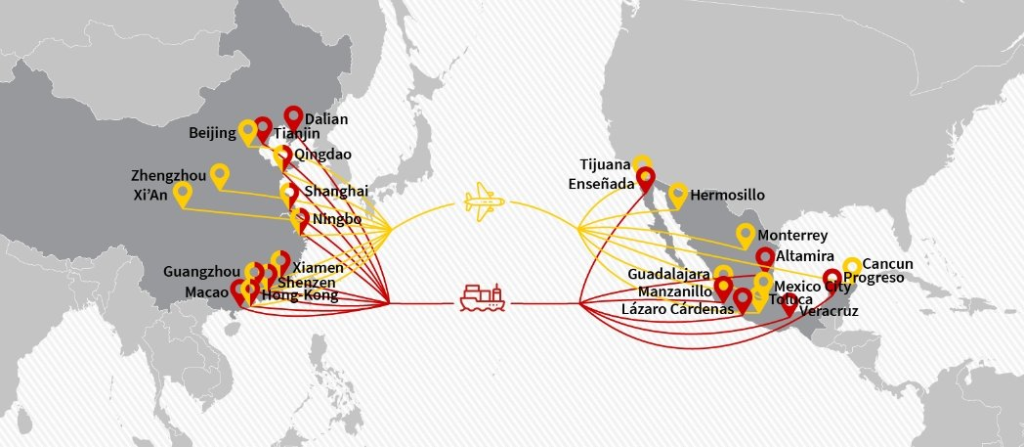

The phenomenon of “nearshoring” and its technical impact

Nearshoring, i.e., the movement of a company, or part of its operations, to a country adjacent to its headquarters, is emerging as a significant trend with technical implications for the container market.

Increase in China-Mexico trade

A 26.2 percent increase in container trade between these two countries is reshaping global logistics routes.

Pressure on border crossings

A record increase in crossings at the U.S.-Mexico border, particularly in Laredo, Texas, is creating new logistics challenges and opportunities for the container market.

Impact on inland prices

The redistribution of container flows is leading to a decrease in availability at inland locations in the U.S., resulting in upward pressure on trading prices in these areas.

Map of major nearshoring container flows, with focus on the China-Mexico-US corridor (source basenton.com)

Technical forecast for 2025

Based on current trends and available data, some predictions for the container market in 2025 emerge.

Price trends

In 2025, prices are expected to gradually stabilize, although they will remain higher than pre-pandemic levels. However, it is possible that price differences between regions will become more pronounced, influenced by local trade policies and specific economic conditions.

Impact of technology

The deployment of IoT technologies for container tracking, a feature included in Sogese container options, will continue to improve operational efficiency, contributing to a possible lowering of rental and sales costs. In parallel, the adoption of blockchain could increase transparency in transactions, positively influencing the market.

Sustainability and used containers

A growing focus on sustainability will drive demand for used containers, which are considered a greener option than new ones. In addition, innovations in recycling and repurposing containers could increase their residual value, changing the approach to the entire economic life cycle of containers.

Macroeconomic factors

Global monetary policies, particularly central bank decisions on interest rates, will have an impact on financing costs for container purchases, with indirect effects on prices. At the same time, currency fluctuations among major currencies, such as the U.S. dollar, euro and Chinese yuan, will affect global container prices.

Strategies for industry participants

In light of this technical analysis, here are some recommended strategies for container traders:

- Portfolio diversification: Invest in a variety of container types and geographic regions to mitigate risks associated with market volatility.

- Adoption of predictive technologies: Use data analysis tools and artificial intelligence to predict market trends and optimize buying and selling decisions.

- Focus on operational flexibility: Develop rapid container reallocation capabilities in response to changes in trade routes and regional demand.

- Investment in sustainability: Consider acquisition and rental of used containers as a differentiation strategy in an increasingly environmentally conscious market.

- Continuous monitoring of key indicators: Keep tabs on indices such as the xCPSI and other macroeconomic indicators to anticipate market trends.

Conclusion

The container market in the 2024-2025 period is presented as a complex and rapidly evolving ecosystem. Cost dynamics are influenced by a multitude of factors, from geopolitics to technological innovations and global macroeconomic trends. As Christian Roeloffs, CEO of Container xChange, points out, “The container market has entered a new era of complexity. The key to success will be the ability to quickly interpret market signals and adapt with agility to new global logistics realities.” To successfully navigate this changing market, operators will need to take a multidisciplinary approach, combining data analysis, operational flexibility and a deep understanding of global dynamics. Relying also on experts with extensive container availability is another plus point. Only then will it be possible to turn challenges into opportunities and thrive in an industry that remains critical to the global economy.